The rise in renewable energy

Following our annual fund review and due to popular demand we are pleased to give you access to a renewable energy fund alongside our regular energy funds within the Oracle, Paragon, and Quantum fund ranges.

What is a renewable energy fund?

Renewable or alternative energy funds generally invest in the companies operating in the alternative energy industry.

The demand for coal, oil and gas is a constant but the ability to extract these will not last forever. As these resources become scarcer the prices of these will surely rise. Perhaps good for investors in energy companies when that happens, but it does beg the question about the value of alternative or renewable energy resources for the future.

Often referred to as ‘clean energy’ or ‘green’ power because it doesn’t pollute the air or water, renewable energy comes from resources such as wind, solar and hydro. Unlike coal, oil and gas which once extracted will not quickly be replaced; nature continues to provide wind, sunshine and water.

It is fair to say that Governments are mostly in favour of supporting alternative or renewable energy sources as they are significantly better for the environment and represent a way of reducing a country's ‘carbon footprint’, especially in light of the Kyoto Protocol.

REN21

The Renewable Energy Policy Network for the 21st Century is a global renewal energy policy network that provides international leadership towards the rapid global transition to renewable energy. In their 2013 published report it stated that 138 countries had defined renewable energy targets, and support policies were in place in 127 countries, two thirds of which are developing and emerging economies. In their newly published 2014 report this increased to 144 countries with defined renewable energy targets, and support policies in place in 138 countries. Click on the links below to read the full reports:

Renewables 2013 Global Status Report

Renewables 2014 Global Status Report

We have added the Guinness Alternative Energy fund (available in EUR, GBP and USD) to our Oracle, Paragon and Quantum products. This ethically categorised fund sits within the Commodity & Energy sector of our investment guides.

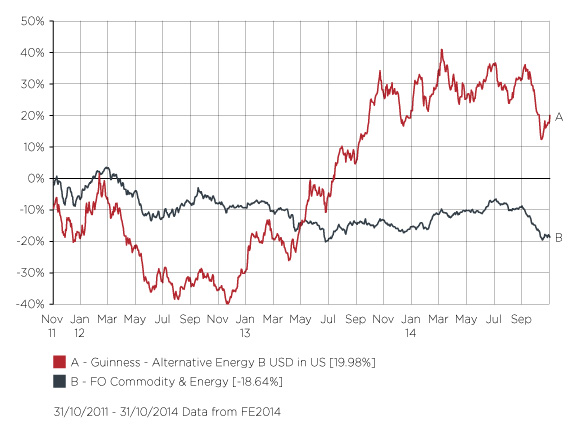

Cumulative performance of the USD share class vs sector average over 3 years to period ending 31/10/2014. Source: FE

Please note that past performance may not be repeated, therefore it must not be used as a guide to future performance. These figures have been supplied for information purposes only and are not an invitation to purchase an investment on the basis of information given, nor do they constitute investment advice. The price of units in the investment funds reflect the value of the underlying assets of the funds and can go down as well as up. Where a fund invests in overseas securities, the unit price may also rise and fall purely on account of exchange rate fluctuations. RL360 Insurance Company Limited is not responsible for, and will not compensate Policyholders in relation to, the performance of their underlying funds.

22 new fund links for Oracle, Paragon and Quantum

This is just one of a number of new funds that we have introduced into our fund range. Find out about the new funds here. View our updated investment guides in the panel (right).