What is the 5% Allowance?

One of the main features of using an offshore plan is the ability to take withdrawals of up to 5% of the premium paid each plan year without triggering an immediate tax charge. This is known as the 5% allowance.

The 5% allowance

Section navigation

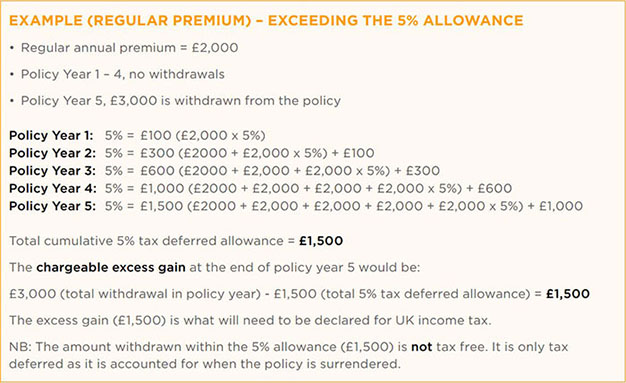

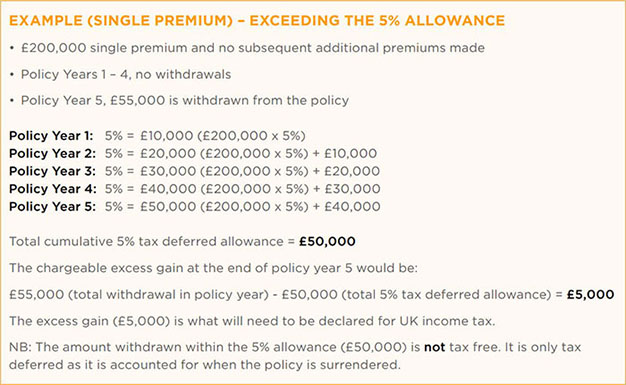

For each premium paid into a policy, an amount equal to 5% of that premium can be withdrawn each policy year for 20 years without an immediate liability to income tax. This is due to the fact that for tax purposes, withdrawals taken within the 5% allowance are treated as a return of the original capital paid.

If the 5% annual allowance is not fully used in any policy year, the unused allowance will be carried forward to the next policy year and so on, on a cumulative basis.

The total amount withdrawn in any policy year will be compared with the cumulative total of unused 5% allowance at the end of that policy year and any excess will be a chargeable gain.

The total allowance is limited to 100% (5% x 20 years) of each premium. Therefore, where the regular withdrawals cease and the total allowance has been used in full, any further withdrawals taken are treated as chargeable excess gains.