Investment Styles – Value versus Growth

You may have heard of the terms ‘Value’ and ‘Growth’ in respect of investment funds but what do these terms represent?

There is a view within the investment industry that there are two approaches to stock selection for equity based funds, value and growth.

Value investing

This approach seeks to identify companies that are trading at a price in the market that is lower than the value of its assets and liabilities. There then exists an opportunity to buy into that company at a discount, with the expectation that the market will rise or the company’s fundamental value will be reassessed. Research is undertaken by the investment manager to identify these opportunities.

Value investing tends to often contradict the market and funds taking this approach can often look like they are behind their peers, however patient investors can be rewarded by the focus on fundamental value of companies rather than strictly purchasing shares in more well-known names, which could be expensive.

Growth investing

This approach to stock selection focuses on companies which are believed to be able to outperform their peers, sector or industry. There is a focus on future earnings potential and little regard to whether the stock is considered overpriced or expensive. This approach can mean a focus on up and coming companies in disruptive industries or huge multi-national household names that continue to provide strong results.

Many funds adopt a deep value or growth position, which will be reflected in their investment objective and policy. However, many funds will look to adopt a blend of the two styles.

The type of investment style adopted can mean different behaviours; growth stocks tend to do better in strong markets, where earnings rise and interest rates fall, whereas value stocks tend to do better when the economy slows. A mix of both styles will provide diversification within your portfolio.

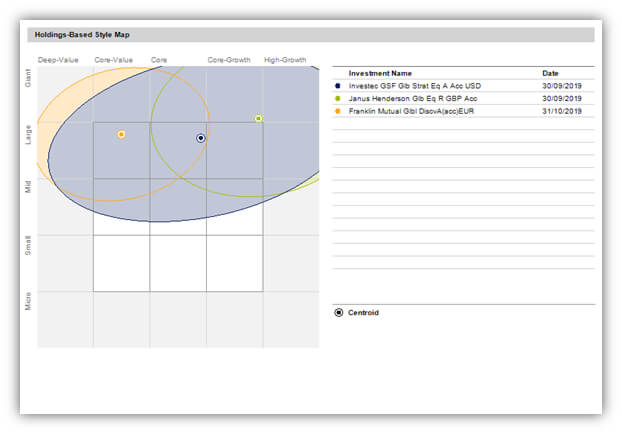

Holdings-Based Style Map

The below is a proprietary chart used by Morningstar to show the style of a fund, coupled with the average size of companies it invests in.

Style is mapped across the horizontal axis, with deep-value on the left of the chart and deep-growth to the right. Blend funds will be plotted between the two poles.

Market capitalisation, or size of companies the fund invests in, is plotted on the vertical axis, with small companies at the bottom and giant companies at the top.