Gift Trust

The RL360 Gift Trust allows an individual to make a gift into a trust¹ and potentiallyreduce their UK Inheritance Tax (IHT) liability.

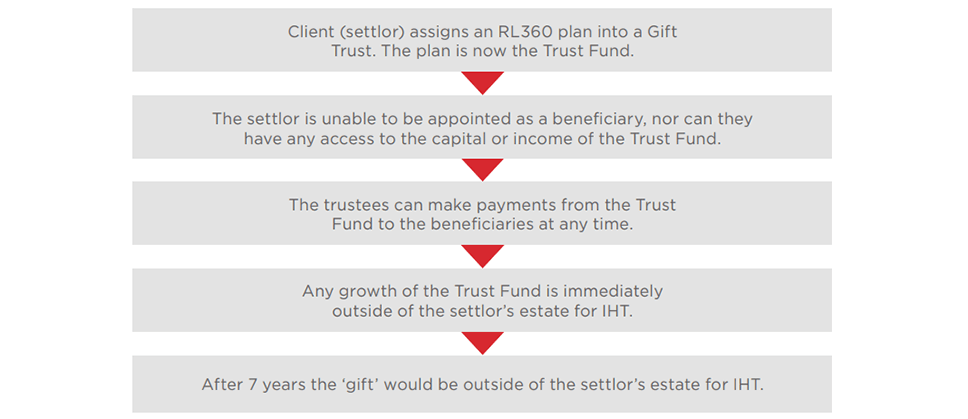

How does it work?

Points for consideration

- The RL360 plan can be gifted at any time into the Gift Trust

- The Gift Trust is only suitable for those looking to make an outright gift in a tax efficient way. Therefore, the settlor cannot benefit from the trust

- The trustees can make payments to the beneficiaries at any time

- Any growth of the Trust Fund is outside of the estate from commencement of the trust

- The Gift Trust will avoid the need for obtaining Isle of Man Probate>

1 Depending on trust provisions, transfer of the plan will either be a potentially exempt transfer (PET) if a Bare Trust (Absolute Beneficiaries) or a chargeable lifetime transfer (CLT) if a Discretionary Trust (Flexible Beneficiaries).

Client scenario

The problem

Mr Jones’ current wealth exceeds the nil-rate band (NRB). In addition, he holds an investment of £100,000 from a recent inheritance.

His adviser has informed him of the potential IHT liability that might befall his estate on death. If he were to die today, just considering the investment, there would be an IHT charge of £40,000 (£100,000 x 40%).

Assuming growth of 6% per annum2, after 25 years the investment could have increased in valued to £440,000. Therefore, the potential IHT charge on the investment could be £176,000 (£440,000 x 40%).

The RL360 Gift Trust solution

As Mr Jones feels that he no longer requires access to any of the Income or Capital from the investment, he has decided to set up an RL360 plan with an investment of £100,000 and gift the plan into a Gift Trust, naming his 2 children as the beneficiaries of the Trust Fund.

To retain some control over how and when the Trust Fund will be distributed, he sets the Gift Trust up as the discretionary version and appoints himself as one of the trustees.

His adviser makes him aware that the investment (£100,000) into the Gift Trust is classed as a CLT and will remain inside of his estate for 7 years. However, from day one, any growth of the Trust Fund will be immediately outside of the estate for IHT.

2 The 6% growth is an example only and is not guaranteed.

Assuming growth of the Trust Fund at 6% per annum2:

- After 7 years the Trust Fund could increase in value to £152,000. Assuming that the Mr Jones (the settlor) survives these 7 years, the original capital (£100,000) and the income (£52,000) will both be outside of Mr Jones’ estate for IHT.

- After 25 years the Trust Fund could increase in value to approx. £440,000. Total growth of £340,000 (£440,000 - £100,000), all of which is outside of the estate for IHT.

Lean more about the benefits of the Gift Trust by reading our separate Guide to Trusts.

Important notes

Please note that every care has been taken to ensure that the information provided is correct and in accordance with our current understanding of the UK law and HM Revenue and Customs (HMRC) practice as at April 2025. You should note however, that we cannot take on the role of an individual taxation adviser and independent confirmation should be obtained before acting or refraining from acting upon the information given. The law and HMRC practice are subject to change.