Discounted Gift Trust (DGT)

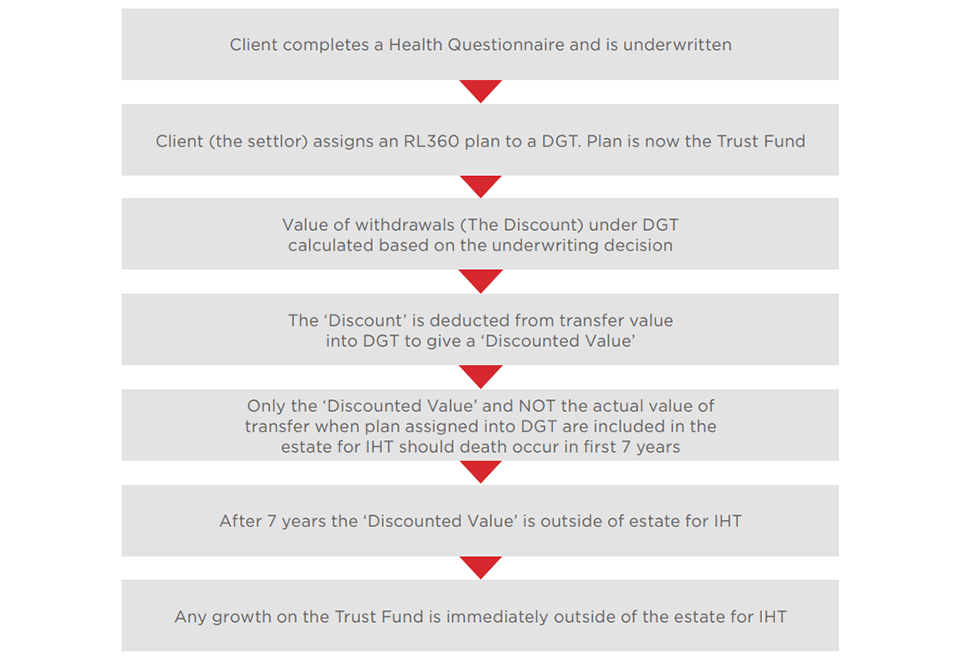

RL360’s Discounted Gift Trust (DGT) allows individuals to gift a plan into a trust¹, receive an income for life (or until funds have been exhausted), and, subject to successful medical underwriting, immediately reduce the value of their estate for UK Inheritance Tax (IHT) purposes.

The DGT process

¹ Depending on trust provisions, transfer of the plan will either be a potentially exempt transfer (PET) if a Bare Trust (Absolute Beneficiaries) or a chargeable lifetime transfer (CLT) if a Discretionary Trust (Flexible Beneficiaries).

Example

The problem

Mr Smith’s (aged 62) wealth of £1,000,000 exceeds the current nil rate band (NRB) which is fixed at £325,000 until April 2026. He is concerned about the IHT charge that might befall his estate on death. If Mr Smith were to die today, he would have a potential IHT liability of £270,000. The current liability is calculated as follows:

- £1,000,000 less £325,000 (NRB allowance) = £675,000

- £675,000 x 40% (current IHT tax charge) = £270,000

The RL360 DGT solution

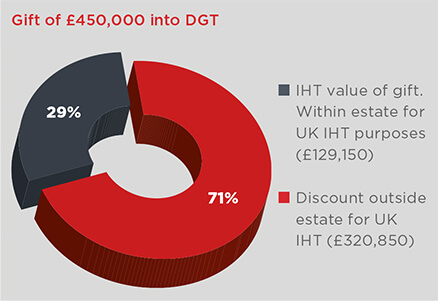

He makes an investment of £450,000 into an RL360 DGT. He decide to carve out an immediate yearly income of £22,500 (£450,000 x 5%)* from the trust, payable on a monthly basis.

* 5% is selected to ensure withdrawals are kept within the cumulative 5% allowance rule for UK chargeable event purposes.

In accordance with HM Revenue and Customs (HMRC) guidance, the withdrawals to be paid to the settlor in his lifetime are valued at £320,850 and so the value of their gift is discounted down to £129,150 (£450,000 - £320,850).

The discounted value of £129,150 will be the amount that is used to calculate their IHT liability, should Mr Smith die within 7 years of making the gift.

The IHT payable on death is calculated as follows:

- £1,000,000 (original estate value) - £320,850 (DGT discount) = £679,150

- £679,150 (new estate value) less £325,000 (NRB allowance) = £354,150

- £354,150 x 40% (current IHT tax charge) = £141,660

The result is an immediate reduction of IHT payable if death occurs within the first 7 years, saving the estate: £127,478.80 (£270,000 - £141,660)

After 7 years, the remaining £129,150 will then be outside of the settlor’s estate for IHT purposes.

Any growth of the investment is immediately outside of the settlor’s estate for IHT purposes.

Important notes

For financial advisers only. Not to be distributed to, nor relied on by, retail clients.

Whilst these case studies highlight the opportunities for planning, they are not intended to provide an exhaustive analysis of all the opportunities or pitfalls. Please note that every care has been taken to ensure that the information provided is correct and in accordance with our current understanding of the UK law and HMRC practice as at April 2025. You should note however, that we cannot take on the role of an individual taxation adviser and independent confirmation should be obtained before acting or refraining from acting upon the information given. The law and HMRC practice are subject to change.