Isle of Man Probate Trust

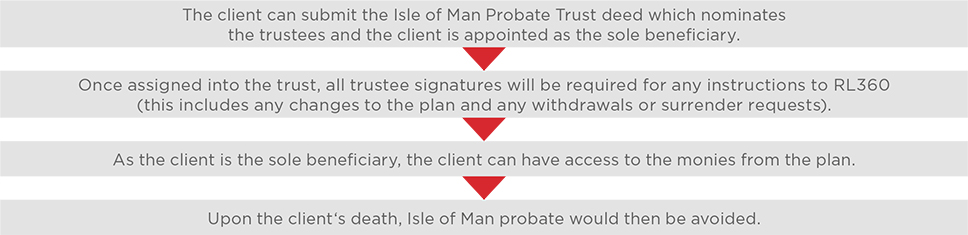

The RL360 Isle of Man Probate Trust is designed for those individuals who wish to avoid the need for obtaining Isle of Man Probate upon their death. This allows the plan proceeds to be paid without undue delay.

If the client is UK long term resident, then upon the client’s death, the value of the plan is included in his or her estate for UK Inheritance Tax (IHT) purposes.

Issues for consideration

- The Isle of Man Probate Trust can be used with a new application for an RL360 plan, or with an existing RL360 plan. However, this cannot be used where the existing plan is owned by a company or a trust.

- If it is decided at a later date that the client no longer wishes to have the plan in the trust, then the trustees can assign the ownership of the plan back to the client.

- Upon the death of the client, the trustees are bound by the terms of the client's will or the laws of intestacy as to who they can distribute the proceeds of the plan to.

- If there are surviving lives assured, or the plan is written on a capital redemption basis, the trustees can assign the ownership of the plan or plan segments to a beneficiary aged 18 or over.

- If the client is UK long term resident, please note that the trust does not provide any UK Inheritance Tax (IHT) benefits. The value of the plan will form part of the client’s estate for UK IHT.

Important notes

Please note that every care has been taken to ensure that the information provided is correct and in accordance with our current understanding of the UK law and HM Revenue and Customs (HMRC) practice as at April 2025. You should note however, that we cannot take on the role of an individual taxation adviser and independent confirmation should be obtained before acting or refraining from acting upon the information given. The law and HMRC practice are subject to change.