Beneficiary Trust

The RL360 Beneficiary Trust allows an individual to nominate beneficiaries to receive the proceeds of their policy after death via a trust. This Beneficiary Trust is intended for plan owners who are non-UK long term resident.

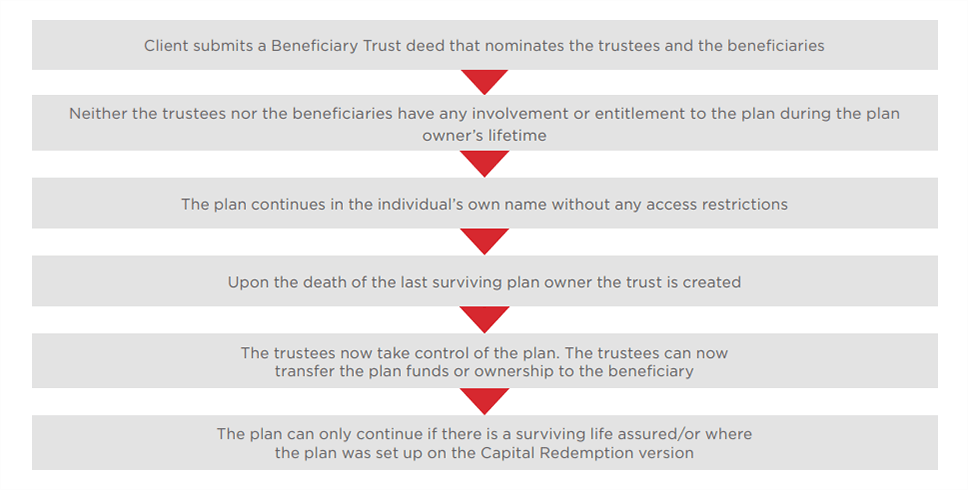

How does it work?

Issues for consideration

- The Beneficiary Trust does not come into force until the death of the last surviving plan owner

- A Beneficiary Trust can be revoked/cancelled at any time during the lifetime of the plan owner.

- Submitting a new Beneficiary Trust will revoke/cancel the current the Beneficiary Trust.

- A Deed of Assignment will revoke/cancel any Beneficiary Trust.

- It not possible to use the Beneficiary Trust where the plan is owned by a company or trust.

- A company or trust can be appointed as a Trustee or Beneficiary

- The Beneficiary Trust cannot be used where the plan is written on a joint life first death basis.

- The Beneficiary Trust avoids the requirement for obtaining Isle of Man Probate.

Important notes

Please note that every care has been taken to ensure that the information provided is correct and in accordance with our current understanding of the law and HM Revenue and Customs (HMRC) practice as at April 2025. You should note however, that we cannot take on the role of an individual taxation adviser and independent confirmation should be obtained before acting or refraining from acting upon the information given. The law and HMRC practice are subject to change. Legislation varies from country to country and the plan owner’s country of residence may impact on any of the above.