Morningstar ESG Risk Ratings Explained

What is the Morningstar ESG Risk Rating?

Morningstar has created the Morningstar ESG Risk Rating to help investors use environmental, social and governance (“ESG”) information to evaluate portfolios. The intention was to provide a reliable, objective way to evaluate how investment funds are meeting environmental, social and governance challenges based on the ESG risk ratings of the companies in which they invest. The ESG risk ratings are provided by Sustainalytics, a leading provider of ESG research. The rating system was initially launched in 2016 called Morningstar Sustainability Rating, was enhanced in 2019, and at the end of March 2025 changed name to Morningstar ESG Risk Rating.

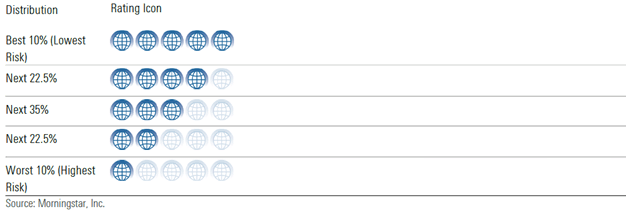

The Morningstar ESG Risk Rating is calculated by scoring every portfolio reported by a fund over the previous twelve months to determine a portfolio score. To receive an ESG risk rating score, at least 67% of a fund’s assets must have a company ESG risk rating. The ESG risk rating is updated once a month with the most recent portfolio for each fund. This portfolio score is then compared to all other funds in the same Morningstar Global Category and a rating assigned according to the fund position relative to its peers as follows:

So, 5 globes means the fund sits within the top 10% of similar funds when scored for ESG risk.

What does this mean?

The intention of the Morningstar ESG Risk Rating is to provide an objective measure for how a fund is managing ESG risks. A fund with a 5/5 score has underlying investments that are considered strong at interacting with the environment around them, the people that they deal with and are well governed. This should mean that they are well equipped to deal with future market environments, take advantage of opportunities and survive through regulatory change.

What is the Morningstar Low Carbon Designation?

The Morningstar Low Carbon Designation is given to funds that exhibit low overall carbon risk and have lower-than-average exposure to companies with fossil-fuel involvement.

Carbon risk is an assessment of how vulnerable a company is in the transition away from a fossil-fuel-intensive economy. Risks include policy and legal regulations that limit carbon emissions or put a cost on carbon emissions; public and consumer pressure on companies to align their strategies with the Paris Agreement’s 2-degree scenario; and switching costs to new green technologies.