Africa's momentum has just begun

The world is changing - fast. As developed economies struggle to ignite pace to their ailing recovery, other parts of the world are growing rapidly, narrowing the gap with rich nations.

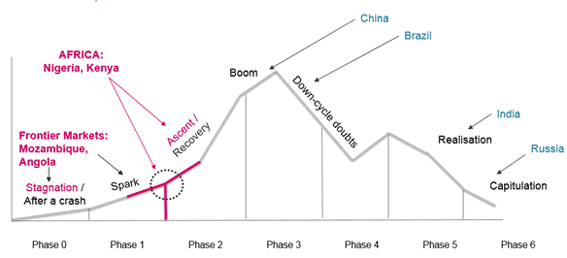

Source: Renaissance Asset managers and "Tomorrow's Gold", by Marc Faber

Twenty years of credit bonanza in Europe and the US are now forcing the citizens and governments of developed markets into stringent spending cuts that are bringing them back to their pre-crisis and more levelled means.

In Africa, the opposite is happening: After decades of external neglect, citizens and governments are at last visibly setting the fundamentals of a future more in tune with the continent’s vast potential and resources. Better education, more access to technology and an increasing democratic mentality are pushing some leading African nations towards full development. Unlike developed markets, their mood is an optimistic one. When traveling around the continent, one doesn’t see rioting protestors, but cranes.

Investors have the opportunity to participate in this positive trend, as companies in leading countries such as Nigeria, Kenya or Morocco expand to supply their products and services to a growing population: Africa, home of six of the ten fastest-growing countries this decade, is expected to double its population to 2 billion people over the next three decades – a move that is expected to make the continent the “new China” in terms of strong manufacturing and buoyant internal demand. Italian fashion brand Ermenegildo Zegna, for instance, just opened shop in Lagos.

As the graphic shows, Africa has only begun its Emerging Market cycle, a multi-year process that starts when a catalyst moves a country out of a stagnant or recessionary phase, fuelling growth. As China and Brazil show, years of fast-pace development often lead to a slow down as economies also need to pause for breath, before settling into a more stable path. But along the way, investments and growth have already delivered hefty returns.

Today, we see in Africa the triggers or catalysts observed in Asia as many as 20 or 30 years ago: in Kenya, political stability is expected to foster investment and corporate visibility following a successful and peaceful election in March; in Nigeria, off-shore oil discoveries are already financing infrastructure projects and improving the country’s balance of payments.

Whilst sub-Saharan Africa often attracts the attention of the increasingly interested global financial press, investment opportunities are also arising throughout the continent, triggered by favourable demographics (with an explosive working-age group), urbanisation, developing tourism and overall general consumption.

Some companies in developed markets have been quick to act: France Telecom, for instance, recently said that its entry into Morocco, the Democratic Republic of Congo and Iraq over the past three years fuelled its Middle East and Africa annual sales growth by 5% to 4.1bn euros – the company’s fastest regional improvement – and it expects the figure to rise to 7bn euros by 2015. Morocco alone is expected to grow at about 4% this year, above the 3.5% emerging and developed market average, according to the International Monetary Fund (IMF).

Diageo or Nestlé are also benefiting from the continent’s surging consumer demand. The UK-based drinks group employs over 5,300 people in Africa – one in four of its total workforce worldwide –, where sales of its Johnnie Walker whisky brand soared 40% in the second half of 2012. The company has increased its investment in the continent by 30% as it continues to grow its established businesses in Cameroon and Ghana. French giant Nestlé said earlier this year that it aims to triple its sales in Nigeria to $2.2bn in ten years as the country’s food and cereal market booms.

Despite these opportunities, Africa is not an easy region and only a fraction of its 55 countries are likely to progress on the path towards stability and development. In Africa, impeccable corporate governance and steady growth can’t always be taken for granted but, at least, more and better information and increased investment is helping observers such as ourselves make better decisions, and continue to benefit from this exciting African ride.