Guinness Asset Management - Why Invest in Asia?

The Asia Pacific region includes both developed and emerging economies, and is home to 54% of the world's population (4.1 billion people). Its population is still younger than the developed world, and is getting richer.

While western economies struggle to sustain economic growth, it is Asia's dynamism, expanding population and increasing wealth that will shape our economic future. If you believe successful investing is about recognising patterns of change to identify value and opportunities for wealth creation, then Asia is the place to look.

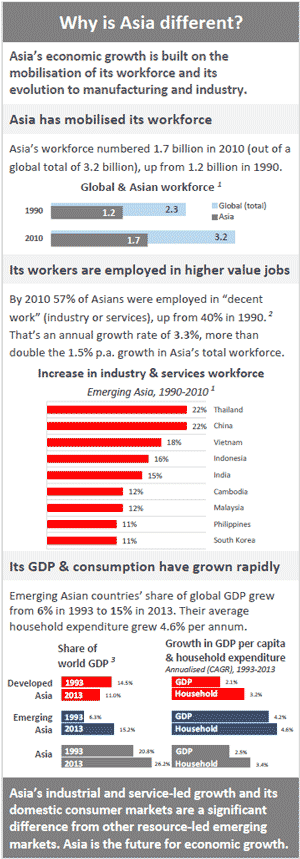

Asia is different from 'Emerging Markets'. Asia is diversified, whereas other emerging markets rely on production of resources or a larger neighbour (or regional trading block). The region has mobilised its resources for the production not only of raw materials but also the full range of manufactured goods (from cheap clothing to top-of-the-range electronics), and is plugged into the global manufacturing network. In 2010 57% of Asia's labour force (almost three in every ten workers in the world and nearly one billion people) was employed in industry or services, with the remainder working in agriculture. this was up from 510 million people or 40% of the labour force in 1990. It is this ongoing shift to "decent work" which generates wealth, fuels rising wages and provides a vibrant Asian market for goods and services. The rise of the Asian consumer, growing more numerous with more money to spend year by year, is the economic force driving change.

Having learned from its own 1998 experience, the region did well through the recent financial crisis. Governments, companies and the financial sector were not over-extended, while companies curbed their expansionary instincts and focused on cash flow generation and profit, leading to a step change improvement in companies return on investment.

Fundamental change to government and society is most often propelled by economic forces. Asia's experience is no different. Increased individual wealth and economic participation has been followed by increased political engagement as people demand a voice in shaping their and their children's future. A demand for government accountability has meant more intensely contested elections - sometimes won by an outsider (as in Indonesia), but all won with a commitment to long-term economic planning and reform. Stock market regulation, accounting and disclosure have improved as financial systems respond to market needs.

"Having learned from its own 1998 experience, the region did well through the recent financial crisis."

There is a long-term investment opportunity in Asia. But opportunity and risk go hand-in-hand; the key for investors is finding proven companies and constructing the right portfolio to manage that trade-off.

Learn more about the Guinness Asian Equity Income Fund

Sources:

1) International Labour Organisation (ILO), World Bank, Guinness Asset Management calculations.

2) ILO, Labour & Socials Trends in ASEAN 2010, Sustaining Recovery and Development through Decent Work.

3) World Bank, in constant 2005 USD, Guinness Asset Management calculations

February 2016

Please note that these are the views of Edmund Harriss and Mark Hammonds, Guinness Asset Management and should not be interpreted as the views of RL360.