Sarasin - Food and Agriculture Opportunities

Deputy fund manager Jeneiv Shah explores how the food economy is evolving, and how they reflect that in their food and agriculture fund.

What do we mean by the food economy and how is it evolving?

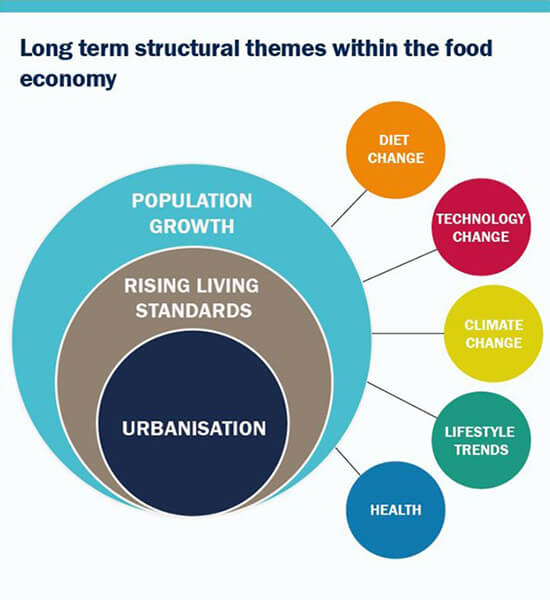

The food economy consists of all the activities and interactions that occur as food is grown, harvested, stored, processed, packaged, sold, and consumed. We have identified three mega-trends that drive the size and evolution of the food economy. These are population growth, rising living standards, and urbanisation. To help understand why we think these three matter, let us look at some data points and statistics that illustrate the growth opportunity available.

Population growth

Our starting point is population growth. In 1950 the world population was 2.5 billion. Today it is over 7.6 billion and in 2050 expected to hit 9.8 billion.1 Put another way, globally there are an additional 65 million mouths to feed each year. That is almost the population of the UK and a significant tailwind to the size of the food economy.

Rising living standards

Now consider rising living standards. On low incomes, humans consume a subsistence diet, largely based on affordable staples such as rice and vegetables. More expensive food categories such as meat and chocolate are usually discretionary, and consumed much less frequently. Research published in the British Medical Journal in 2010 based on data from 164 countries suggests that fruit, unprocessed red meat and fruit juice intake exhibited the largest positive responses to rising incomes globally. The tipping point appears at a per capita annual income of $1,079, or the average level of income within the bottom 10% of earners in the study. At this income level, milk intake appeared most responsive to changes in income within the lowest income nations (10% higher intake from a 10% increase in income), closely followed by processed meat (8%) and sugar-sweetened beverages (6%).2

As incomes rise, we see a change in behaviour resulting in expensive or premium food types added to a person’s regular diet. Considerations such as taste, new experiences, or choosing food for a specific purpose – for a desired physical outcome – can overtake price in a ‘hierarchy of food needs’. Bear in mind that a country’s overall wealth and development plays a part in how the food economy evolves. For example, increased global trade of food products, knowledge of new cuisines via media, and better infrastructure opens up new geographic areas for supermarkets and restaurants to proliferate.

Urbanisation

We also believe urbanisation helps the food economy grow structurally over time, a powerful driver that influences retailer and end consumer behaviour. It is estimated that 91% of global consumption growth between 2015 and 2030 will come from people living in cities.3 Access to modern supermarkets broadens the range and choice of food for sale. Stable, reliable electricity enables homeowners to purchase a fridge for the first time, allowing perishable items such as meat, yoghurt and ice cream to be kept at home. Time spent in offices changes where people eat lunch, whether in canteens or restaurants.

Taking our thematic lens a step further, we can identify many sub-themes that are driving continuous change in food production and consumption. Examples include dietary differences between advanced economies and emerging economies, our willingness to integrate food choices with health and wellness goals, and advances in technology to help farmers improve efficiency. The global fresh food market was estimated to be worth $2 trillion in 2018 and is likely to grow at 3-4% per annum.4 A move to a more environmentally sustainable global food system is underway, typified by high profile work undertaken in an EAT-Lancet Commission report published this January.5 The below image gives a snapshot of a few sub-themes that drive changes in the food economy, creating opportunities for attractive long-term investment ideas.

Finding the sweet spots within the food economy

Turning our thematic philosophy and framework into insights and then uncovering valuable stock investment ideas is critical to building a long-term portfolio. Givaudan, a leading global flavours and fragrance provider, is an example of a company held in the fund with a strong investment case. This compounding growth business operates in oligopolistic markets that have high barriers to entry. Product innovation to meet changing end consumer needs driven by health and wellness, premiumisation, and luxury, is an integral part of the company’s DNA. In addition, there is an ongoing shift towards natural and bio-based ingredients, natural colours, speciality fragrances, clean labelling, and sustainable sourcing. Givaudan, with its recent acquisition of Naturex, is investing to take advantage of these trends and stay ahead of competitors, for example salt reduction in packaged food manufacturing. We would highlight that 43% of Group revenue at Givaudan comes from what they classify as fast-growing end markets (typically natural products, or emerging geographies) which are growing at 7-10% rates per annum.6

The food economy in China is now almost the same size as the US, at approximately $1.5 trillion in 2018. However, the last five years has seen a huge convergence between the two countries – China’s food consumption has increased by a cumulative 175% versus 15% for the US.7 Incredibly, the average Chinese person is eating four times as much meat as 30 years ago and seven times as much dairy, illustrating just how much change has occurred already.8 The fund owns China Mengniu, a leading dairy manufacturer, as we think the company can continue to grow revenue and profit at double-digit rates per annum. However there is one area of China’s ‘food’ spend that is still underpenetrated, and that is wine. We expect the bottled wine market to grow in China due to rising wealth and increasing addressable consumers. Today average per capita consumption is currently around one bottle per annum, which compares to the UK at 28 bottles.9 There is an untapped convergence theme as consumers eat out more or choose a more sophisticated beverage to consume with dinner at home. Treasury Wine Estates, another significant holding in the fund and the owner of brands such as Penfolds, Rawsons Retreat, and Wolf Blass, is a key beneficiary of dietary change and ‘premiumisation’ in China, with approximately a third of its profits coming from Asia.

A fund that takes advantage of an evolving food and agriculture chain

The Sarasin Food & Agriculture Opportunities fund has well-diversified exposure – by sub-theme, geography and food spectrum category – embedded into its portfolio construction process. This ensures that we are always investing in the most attractive parts of the global food economy. We also believe many of our ideas are hidden and underappreciated gems that can continue to grow many years into the future, backed by our thematic framework and approach.

1 United Nations

3 McKinsey

4 Euromonitor

5 The EAT-Lancet Commission on Food, Planet, Health

6 Givaudan company reports

7 USDA, Sarasin & Partners

8 UN FAO

9 The Wine Institute