Fidelity International - Putting sustainability to the test: ESG outperformance amid volatility

At Fidelity International, our research disclosed that the market does, in fact, discriminate between companies based on their attention to sustainability matters, both in crashes and recoveries.

Utilising Fidelity’s Sustainability Ratings, we recently analysed how more than 4,000 companies across equities and fixed income had performed since the March crash. Here, Jenn-Hui Tan, Global Head of Stewardship & Sustainable Investing, discusses the results and outlines the increasingly strong correlation between market performance and sustainability.

Key points

- The securities of companies more highly rated from a sustainability perspective have outperformed those with poorer ratings so far this year.

- Our research supports the hypothesis that a company’s focus on sustainability is fundamentally indicative of its board and management quality and its resilience.

- We found that the strong positive correlation between a company’s relative market performance and its ESG rating held firm across the longer nine-month time frame.The groups with higher ratings fell less as the markets collapsed and rose less when they recovered sharply in April than those with lower ESG ratings.

- The securities of higher rated ESG companies performed better on average than their lower rated peers from 2 January to 30 September, on an unadjusted basis.

- We found that the strong positive correlation between a company’s relative market performance and its ESG rating held firm across the longer nine-month time frame.The groups with higher ratings fell less as the markets collapsed and rose less when they recovered sharply in April than those with lower ESG ratings.

- The quality-adjusted data shows that the bonds of higher rated companies outperformed their lower rated peers both during March’s collapse and April’s recovery.

Fidelity's ESG rating scale

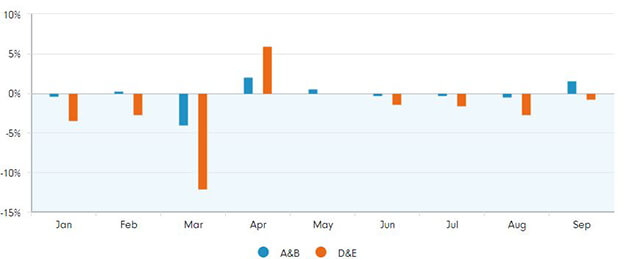

Stocks with higher ESG ratings had better returns in almost every month

ESG ratings and stock performance

Source: Fidelity International, October 2020. Note: Time period is 1 January to 30 September 2020

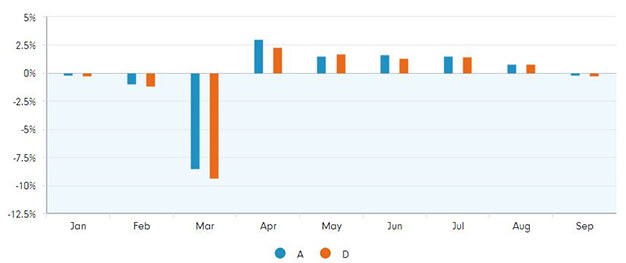

Sustainability is an indicator of resilience in rough bond markets

ESG rating monthly quality-adjusted return

Source: Fidelity International, October 2020. Note: Time period is 2 January to 30 September 2020

Conclusion

Overall, we’re pleased to observe the relationship between high ESG ratings and returns over the course of a market collapse and recovery. Our research suggests that the market does discriminate between companies based on their attention to sustainability matters across a range of conditions. This supports our view that sustainability should be at the heart of active portfolio management and that a company’s focus on sustainability is fundamentally indicative of its board and management quality.

Important Information:

The value of the fund's assets will go down as well as up. This will cause the value of your investment to fall as well as rise and you may get back less than you originally invested.

_______________________________________________________________________

For more information about Fidelity International visit www.fidelityinternational.com/