Alliance Bernstein - A framework for mapping modern slavery risk in investment portfolios

More than 40 million people worldwide are estimated to be victims of various forms of modern slavery, including forced labor, debt bondage and human trafficking. Forced labor alone is estimated to generate profits of US$150 billion a year for the criminals behind it.

This social evil is so pervasive that consumers can unknowingly encounter modern slavery, and investors can have unintended exposures to it within their portfolios. As global awareness of modern slavery grows, governments, businesses and others are working to combat it and taking steps to strengthen company reporting requirements.

Many firms, though, still find it challenging to assess modern slavery exposure not only in their operations but along their global supply chains, even though the stakes are high and the consequences dramatic. Companies must consider more than potential damage to their reputations and bottom lines, because modern slavery risk isn’t like other business risks: it’s a risk to people.

While the industry is still in the early stages of what will likely be a long journey to identify and root out modern slavery, investors, companies and fund managers can all play critical roles. From an investment perspective, this starts with taking a hard look at modern slavery risk in portfolios.

A Framework for Assessing Risk to People

To help identify modern slavery risk, a thoughtful research framework is an important tool. It enables investors to prioritize all the companies in a portfolio’s universe—not just those currently held in the portfolio—based on their potential exposures. We’ve developed a framework that considers four risk factors:

- Vulnerable Populations (including migrant workers, minorities and those from linguistically diverse backgrounds)

- High-Risk Geographies (including those with history of abuses, conflict-affected zones and limited or weak judiciaries)

- High-Risk Products and Services (including raw materials, basic services, internal services and "sweat" shops)

- High-Risk Business Models (including outsourcing, fraudulent recruiters, seasonal demand peaks and franchises)

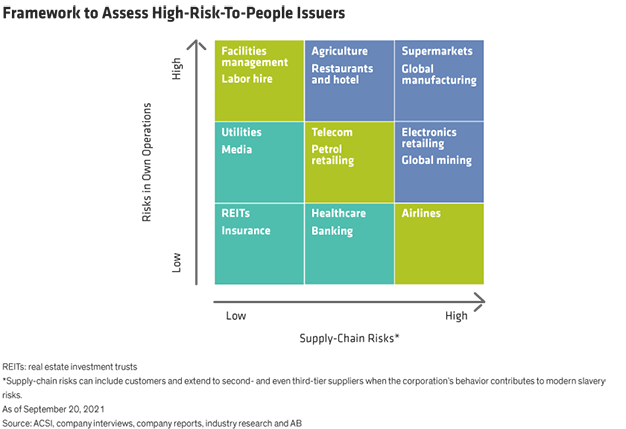

Using our fundamental research and leveraging third-party information as a guide, we map companies on a matrix suggesting the level of exposure in both operations and supply chains. We’re only assessing exposure in this step—not how well or badly a firm manages the risk. In the Display below, we use industries to illustrate the matrix; in practice, individual companies are plotted.

Firms in the upper right would be considered higher risk, so we rank them as the highest engagement priorities. But those companies aren’t our only focus. The matrix represents a risk spectrum: we might consider firms in the lower left to be lesser priorities for engagement, but they’re certainly not risk free.

A company that owns commercial real estate in one country, for example, might still be exposed to modern slavery risk through migrant labor used by a cleaning contractor. So, even though the REITs industry appears in the lower-risk part of the matrix, our company-specific fundamental research might single out a REIT firm from its peer group and assign it to a different quadrant.

Leveraging Specialist Research Perspectives

Many third-party sources of high-quality modern slavery research are relevant to each risk factor.

The Walk Free Foundation’s Global Slavery Index (GSI), for example, provides a country-by-country ranking of the number of people victimized by modern slavery, analyzes governments’ responses and explains the factors that make people vulnerable. The data help us assess individual company exposures based on countries where they conduct operations and/or source supplies.

We’ve found that global awareness of modern slavery risk can inform us about how companies are responding. It’s notable, for example, that supermarket chains in both Europe and the US have joined an initiative to help reduce risks to people in Thailand’s fishing industry. Similarly, electronics, retail, auto and toy companies are working to support the rights and well-being of workers in their global supply chains through the not-for-profit Responsible Business Alliance.

Fundamental Research and Engagement: The Path to a Better Understanding

Mapping companies using the prioritization framework and matrix is only the first step to assessing modern slavery risk. To fully understand individual firms and their modern slavery exposures and actions, investors need to research each company closely, according to its risk priority.

This effort requires more than strong research skills and collaboration between ESG experts and fundamental analysts. It also takes a willingness to engage directly with company management teams and a clear idea of best practices in identifying and managing modern slavery risk.

Equipped with the right tools and processes, investors stand a much better chance of accurately identifying modern slavery risk—and advancing the effort to root out modern slavery all over the world.

This topic is part of a series of insights on how to assess and address potential exposure to modern slavery through the investment process, analyzing companies’ direct business operations and their global supply chains.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein (AB) portfolio-management teams and are subject to revision over time.

_______________________________________________________________________

For more information about AllianceBernstein visit www.alliancebernstein.com