M&G Investments - A Circular Economy: Picking The Easy Net-Zero Fruit

Most nations have today accepted the challenge to cut greenhouse gas emissions to net zero by 2050. The need to replace fossil fuel activities with cleaner energy sources has taken centre stage. However, if we have any intention to reach this goal, incorporating a circular economy will both be a necessity and also represent some of the easiest opportunities we will have to cut emissions.

The scale of the opportunity

By circular economy we mean incorporating an economic system aimed at eliminating waste and the continual use of resources. Circular systems employ reduce, reuse, and recycling to create a closed-loop system, minimising the use of resource inputs and the creation of waste, pollution and carbon emissions. This would replace the take, make and waste approach of traditional linear business models.

The circular system from an economic standpoint aims to keep products, equipment and infrastructure in use for longer, thus improving the productivity of these resources.

Sending waste to landfill is a large source of carbon emissions, by constantly reusing resources and avoiding landfill we benefit both the planet and our own finances.

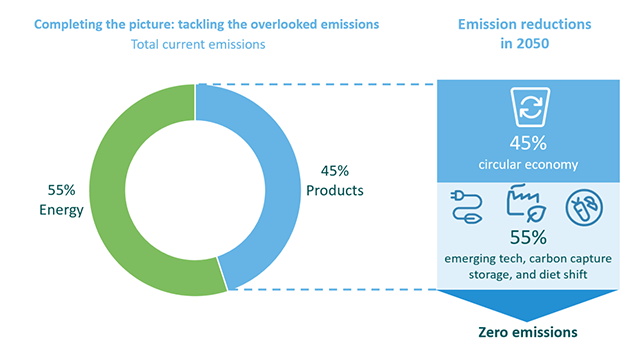

The pivotal role of the circular economy

Source: https://www.ellenmacarthurfoundation.org

Whilst reducing energy related emissions remains the largest effort in our aim to reach net zero, moving to a circular economy provides the opportunity to reduce global emissions by up to 20%.

Recycling products, from copper to plastic means we save energy in not having to mine and create virgin material. The economics are also much better to reuse and recycle than it is to buy and process virgin material.

As regulations develop to get us to net zero by 2050, don’t be surprised over the coming years to increasingly hear the promotion and adoption of a more circular economy.

This is supported by Accenture research, who estimate that the circular economy could generate $4.5 trillion of additional economic output by 2030, their work identifies circular business models that will help decouple economic growth and natural resource consumption while driving greater competitiveness.

At M&G, we have identified a list of companies which promote a circular economy as part of their business models:

Ball Corp is the world’s largest aluminium can manufacturer. Given aluminium can be recycled infinitely, 75% of all aluminium ever produced is still in use today. The global recycle rate for aluminium cans is 69% supported by the fact the residual product has an economic value and can easily be sorted during the collection process. Only 43% of PET (plastic) and 46% of glass bottles were collected for recycling, although not necessarily recycled.

- Impact: Ball Corp helps save 4.25m tonnes CO2e per year. This is the equivalent of removing 945,000 petrol cars off the road for a year. Source: https://nepis.epa.gov/Exe/ZyPDF.cgi?Dockey=P100U8YT.pdf

Brambles is a supply-chain logistics company operating in more than 60 countries. It operates a platform of over 300m pallets and crates which form the invisible backbone of global supply chains, primarily serving the fast moving consumer goods, fresh produce, beverage, retail and general manufacturing industries. The pallets and crates are made from wood and constantly recycled.

- Impact: Brambles help save 1.95m tonnes CO2e per year. This is the equivalent of recycling 650,000 tonnes of waste instead of sending it to landfill. Source: Brookfield Renewable Partners III report (please refer to pg. 24)

Darling Ingredients is a world leader in the recycling of meat-based products and cooking oils. They convert these products back into food, feed, and fuel. By rendering meat by-products, the carbon is captured and reused, rather than released into the environment as a greenhouse gas.

- Impact: In 2019, Darling Ingredients’ Scope 1 and 2 emissions* were 1.8 million tons of CO2, but the company saved 5.5 million tons of CO2. This gives a net-positive climate impact of 3.65 million tonnes of CO2e. This is the equivalent of the estimated annual emissions of the UK city of Leeds. Source: Leeds Carbon Roadmap report, pg. 2 * Scope 1 emissions are all direct emissions from the activities of an organisation or under their control. This includes fuel combustion on site, from owned vehicles and fugitive emissions. Scope 2 emissions are indirect emissions from electricity purchased and used by the organisation. Emissions will be crated during the production of the energy and eventually used by the organisation.

DS Smith is a leader in sustainable packaging, demonstrating the potential of closed-loop recycling – a process whereby waste is collected, recycled, then re-used to make the same product. By using recycled materials in its corrugated boxes, M&G estimates that the UK company saves 55 million trees a year from being cut down. DS Smith’s main customer is internet retail giant Amazon, which gives DS Smith’s operations huge scale and impact.

- Impact: DS Smith’s operations offer a net saving of just over 650,000 tonnes of CO2e per year. This is the equivalent of providing 120,000 homes with emissions free electricity. Source: Brookfield Renewable Partners III report (please refer to pg. 24).

Trex is the largest composite decking producer in the world. Composite decking is more durable and has better sustainability credentials than lumber wood alternatives, which make up a majority of the decking market. Trex also has its own network to collect used plastic and wood, which stops materials being placed in landfill. Compared to wood decking, Trex composite decking is more durable, longer lasting and easier to maintain.

- Impact: In 2019, Trex decking emitted 42% fewer greenhouse gas emissions compared to Alkaline Copper Quaternary (ACQ) treated wood decking. Source: The information source is from the company’s sustainability report, available on their website. trex-sustainability-report-catalog_d15-sspdf.pdf (Page 31 of report).

Source case studies: companies corporate websites from Ball Corporation, Brambles, Darling Ingredients, DS Smith and Trex. These figures are based on the latest information available from company literature and reports.

Important Information:

The value of the fund's assets will go down as well as up. This will cause the value of your investment to fall as well as rise and you may get back less than you originally invested. The views expressed in this document should not be taken as a recommendation, advice or forecast.