Sarasin - The Bigger Picture: The Chinese Economy Recovery

The Chinese economy navigated the ramifications of the pandemic impressively.

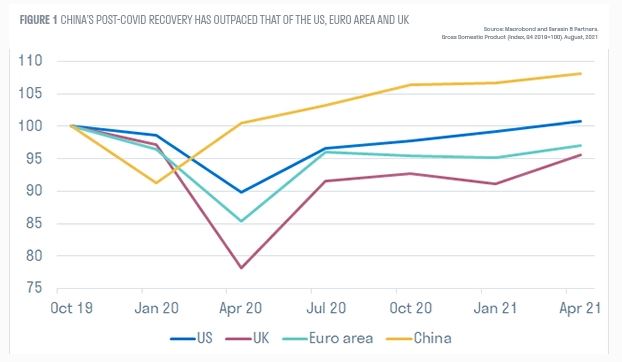

After recording a GDP contraction of 8.7% in Q1 2020, the economy is now not only back to its pre-COVID size but in Q2 2021 was 8.2% larger. In comparison, the US economy has only just regained its pandemic size (Figure 1).

China’s outperformance can be largely attributed to its effective virus suppression strategy, which although highly disruptive, allowed the Chinese economy to re-open faster than most western counterparts, and its export sector to benefit from strong demand for personal protective equipment, electronics and work-from-home goods as the rest of the world grappled with further waves.

Short- and long-term risks persist

Yet, China remains confronted with both short-term risks as virus outbreaks continue and vaccinations have lagged, as well as deep-seated structural challenges which have come closer to the fore.

The surprise move by the PBOC in July to cut the amount that banks must hold in reserves led to questions over the robustness of the underlying economy and raised concerns over an imminent slowdown. Indeed, July economic outcomes disappointed. Heavy rain and floods, together with outbreaks of COVID, led to the re-imposition of strict mobility restrictions in various provinces. The government’s financial de-risking campaign and measures to tame a heated property market will also further weigh on activity in the short term. Momentum is likely to slow as we head into the second half of 2021.

Chinese economy faces demographic challenges

Looking further out to the horizon, the publication of the results of the census this year brought China’s demographic challenges into sharp focus: population growth has slowed further over the past ten years and birth rates have been lower than anticipated, the corollary being that the population is likely to peak before 2025 –- around seven years earlier than current UN medium fertility projections. In a major policy shift, the government responded; the two-child policy was eased to a “three-child” policy. Social policies are rising higher on the priority list, including pledges to support families with the high cost of childrearing, but much more needs to be done including reducing out-of-pocket healthcare costs, expanding coverage of unemployment insurance and increasing the portability of pension benefits nationally. The OECD, in its “Going or Growth” 2021 publication, notes that the pandemic widened inequalities in China, including between inland vs coastal regions, poorer vs wealthier households, and private corporate vs state-owned enterprises. Reducing these divides will help make growth more inclusive and sustainable.

Important information

If you are a private investor, you should not act or rely on this article but should contact your professional adviser. Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

It has been prepared solely for information purposes and is not a solicitation, or an off er to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verifi ed such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

Neither Sarasin & Partners LLP nor any other member of Bank J. Safra Sarasin Ltd. accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment.