Matthews Asia - Market Viewpoint

Macro Tailwinds for Emerging Markets

David Dali, Head of Portfolio Strategy, provides his 12-month outlook for global equity markets.

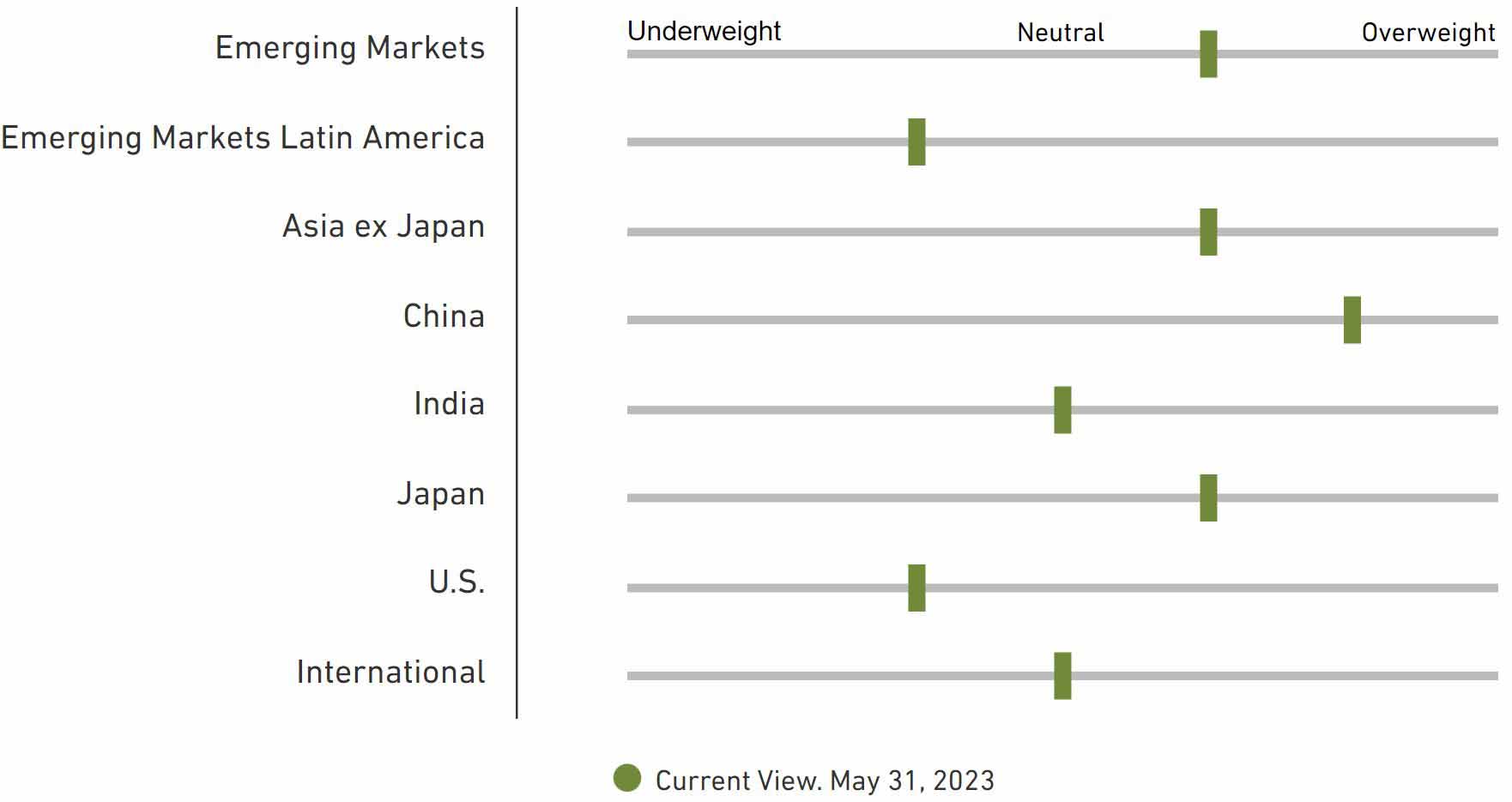

While investment sentiment has softened since January, I remain positive toward emerging markets and Japan given their relatively attractive valuations and the prospect of a more favorable macro climate ahead.

Market Views: Based on a 12-month outlook for key global equity markets

This information is presented solely for illustration purposes and is not representative of the results of any particular security or product. Forecasts are based on proprietary models and there can be no assurance or guarantee that forecasts can or will be achieved.

Emerging Markets

- Emerging markets (EM) have endured negative sentiment over China and heightened fears of a policy-induced global slowdown. Yet going forward I support an overweight position due to the positive trajectory of EM economies versus developed market (DM) peers, valuations that assume elevated risk premiums, relatively robust earnings expectations and a peaking in U.S. dollar-strength.

- Regionally, I have an underweight stance in Latin America given the relative outperformance at the start of 2023. While Brazil and Mexico have maintained extraordinarily tight monetary policies which should support their currencies, I expect the recent outperformance of Mexico’s equity markets to wane and Brazil’s fiscal discipline to remain a formidable challenge.

- I remain more positive toward Asia ex Japan. South Korea and Taiwan are susceptible to swings in the world economy; however, barring a pronounced global downturn both should experience steady demand for their advanced technology and manufactured goods and services.

- Looking at single countries, the direction of China’s recovery, to me, seems clear and upward sloping. The ‘valuations versus expected earnings’ equation also clearly supports higher equity prices medium term. The question remains whether geopolitical tensions will allow for an improvement in sentiment. In my view, fundamentals and earnings will prevail and China should be one of the best performers in the coming 12 months.

- India’s six-month underperformance has been significant and index valuations have moved from relatively ‘very over-valued’ to just ‘mildly over-valued.’ The country’s equity markets remain a beneficiary of U.S.–China tensions and its economy is resilient and robust.

Developed Markets

- In the U.S., inflation-led pricing power has allowed companies to avoid a hit to earnings so far; however, regional bank stress will likely restrict credit just as higher rates begin to hamper consumer demand. As a result, I would expect a more difficult earnings environment in the next 12 months amid already elevated valuations.

- Japan has been buoyed by China’s re-opening and relaxation of international travel restrictions. In addition, Japan is increasingly becoming a ‘friendly’ destination for advanced technology manufacturing. The central bank’s potentially smooth exit from its yield curve control (YCC) policy and the attractively valued currency make Japan one of the most defensive developed markets.

- Europe faces macro headwinds, including volatile energy prices, the impact of the war in Ukraine, tightening financial conditions and lower earnings-growth consensus. Companies in defensive sectors such as health care or those exposed to recovering economies in Asia should fare better during a global slowdown.

David Dali has spent much of his career in broad emerging markets as a macro-focused portfolio manager, investing in equities, fixed income, currencies and derivatives.

Notes:

Emerging Markets is based on the MSCI Emerging Markets Index, which captures large and mid cap representation across 24 Emerging Markets countries. Constituents include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

Emerging Markets Latin America is based on the MSCI Emerging Markets Latin America Index, which captures large and mid cap representation across five Emerging Markets countries in Latin America, including Brazil, Chile, Colombia, Mexico, and Peru.

Asia ex Japan is based on the MSCI AC Asia ex Japan Index, which captures large and mid cap representation across two of three Developed Markets (DM) countries, excluding Japan, and eight Emerging Markets (EM) countries in Asia. DM countries include: Hong Kong and Singapore. EM countries include: China, India, Indonesia, Korea, Malaysia, the Philippines, Taiwan and Thailand.

China is based on the MSCI China Index, which captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

India is based on the MSCI India index, which is designed to measure the performance of the large and mid cap segments of the Indian market.

Japan is based on the MSCI Japan index, which is designed to measure the performance of the large and mid cap segments of the Japanese market.

U.S. is based on the MSCI USA index, which is designed to measure the performance of the large and mid cap segments of the U.S. market.

International is based on the MSCI World ex USA index, which captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries-- excluding the U.S. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the U.K.

June 2023

Please note that these are the views of David Dali of Matthews Asia and should not be interpreted as the views of RL360.