Schroders - Earth Overshoot Day 2023 Article for investors

As of today, we have used up the planet’s natural capital budget for the year. What does this mean for investors?

Planet earth naturally generates a certain amount of natural capital or ecological resources each year. Think of the forestry, agricultural (both crop and livestock) and built-up land, fishing grounds or any other type of environmental resource needed to support economic activity, including biological assets needed to absorb our waste such as our greenhouse gas (GHG) emissions.

Earth Overshoot Day is the day on which we consume more ecological resources, or natural capital, than the earth produces. It is essentially the day that our budget runs out.

When in the year does Earth Overshoot Day usually fall?

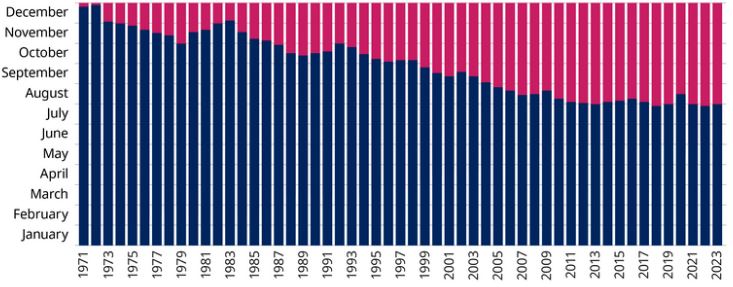

As recently as the early 1970s, Earth Overshoot Day fell in late December. This was sustainable – we were consuming as much resources as were being created, demand equalled supply and the budget balanced.

The issue is that as populations and living standards have risen, our demand for resources has exploded. This has resulted in Earth Overshoot Day falling further and further towards the start of the year.

In just 50 years we have gone from consuming one Earth worth of resources per year to nearly two today.

Earth Overshoot Day - 1971 - 2023

Source: National Footprint and Biocapacity Accounts 2023 Edition, data.footprintnetwork.org

The Global Footprint Network calculates that Earth Overshoot Day for 2023 occurs today, August 2. This means that for the full year, we will be using up to around 1.7x worth of Earth’s annual resources.

By 2050 on current trends, with the UN estimating the global population to be close to 10 billion, we would need the equivalent of three planet earths – meaning Earth Overshoot Day would fall in early May.

It’s important to note that these figures are for planet Earth as a whole – looking at individual countries can paint a much grimmer picture.

For example, if everyone on earth consumed like the US then Earth Overshoot Day would fall on March 13. This means that we would be using up our budget for the year after just 71 days, and using the equivalent of five planet earths.

Most advanced economies tend to show a similar dynamic. Earth Overshoot Day fell on May 19 for the UK, May 11 for France, May 4 for Germany, April 3 for Sweden, May 6 for Japan and March 22 for Australia.

Most emerging economies tend to score better on this metric but are still overspending their budget. China saw Earth Overshoot Day fall on June 2, countries like Indonesia see it fall on December 3, whereas Brazil sees it on August 12.

The logical issue that arises from this is that as living standards rise in developing economies, so too does resource consumption.

This puts the planet on a dangerous path as we continually overspend our resource budget, pushing ourselves further and further into a natural capital deficit.

This cannot go on forever.

How can we balance the budget – and what are the opportunities for investors?

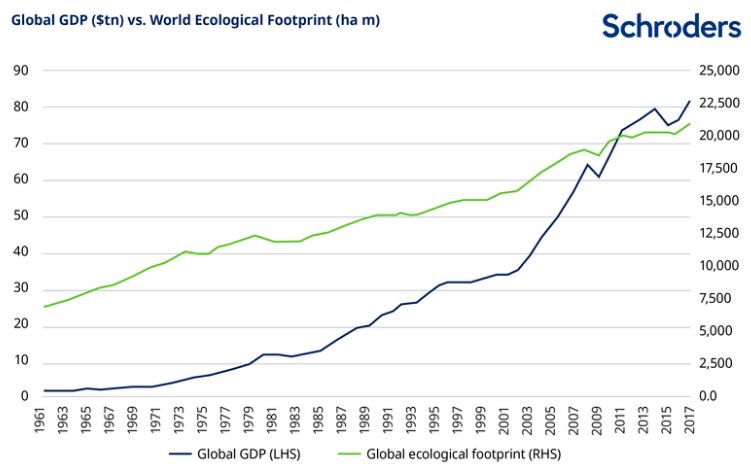

The simple answer to this issue is to decouple economic growth from resource consumption.

This is easier said than done given that GDP and our ecological footprint have a 96% correlation.

Governments, companies and consumers are increasingly waking up to this challenge. This focus is helping to create growth opportunities for companies which can deliver solutions to our resource and overconsumption problems.

We see the circular economy theme as one of the strongest secular growth trends over the coming decades. There is an opportunity to invest in the companies, both in the listed and private markets, that can enable it.

Our confidence in this trend comes from the fact that a circular economy transition simply has to occur. Demand for natural capital cannot keep rising and deficits keep building against what is a relatively fixed supply of natural resources. We’ve only got one planet Earth.

We believe the opportunity for investors to see outsized returns in this space is high as when demand exceeds supply the opportunity for economic profits is created.

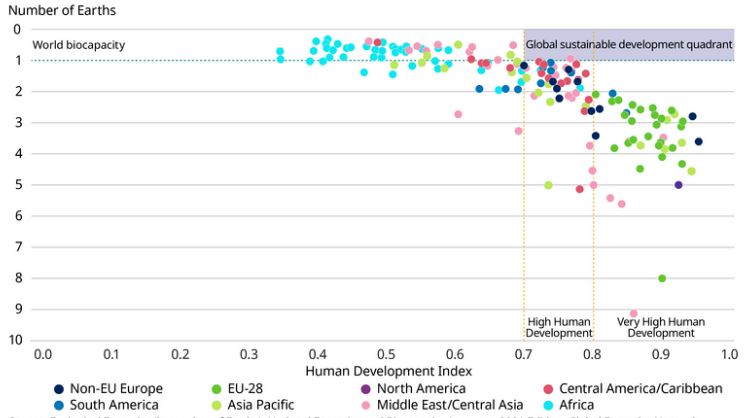

Ecological Footprint and Human Development Index of countries (2017)

Source: Ecological Footprint (in number of Earths): National Footprint and Biocapacity Account, 2021 edition, Global Footprint Network Human Development Index: Human Development Report, 2020, United Nationals Development Programme

As can be observed in the chart at the top the only times in history when Earth Overshoot Day moved back was in times of recession – Covid-19 and the Great Financial Crisis, for example. If the answer to sustainability is negative economic growth, then it’s the wrong answer.

Similarly, the above graphic highlights that the countries or regions that are living within their natural capital budgets tend not to have high standards of living as per the UN’s Human Development Index. If the answer to sustainability is lower living standards, then, again, it is the wrong answer.

This leads us to believe that the only solution to our resource issue is to transition to a circular economy.

This is an economy where a focus on efficiency helps design out waste and pollution, where products and materials are kept in use and where we use renewable resources in lieu of non-renewable ones like fossil fuels.

Governments, companies and consumers are increasingly waking up to this challenge. This focus is helping to create growth opportunities for companies which can deliver solutions to our resource and overconsumption problems.

We see the circular economy theme as one of the strongest secular growth trends over the coming decades. There is an opportunity to invest in the companies, both in the listed and private markets, that can enable it.

Our confidence in this trend comes from the fact that a circular economy transition simply has to occur. Demand for natural capital cannot keep rising and deficits keep building against what is a relatively fixed supply of natural resources. We’ve only got one planet Earth.

We believe the opportunity for investors to see outsized returns in this space is high as when demand exceeds supply the opportunity for economic profits is created.

Important Information

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.

August 2023

Please note that these are the views of Schroders and should not be interpreted as the views of RL360.