How are Chargeable Events calculated & who is liable?

Chargeable events most commonly arise where there has been an excessive withdrawal or one or more policies has been surrendered.

Calculation & liability

Section navigation

HOW IS A CHARGEABLE EVENT CALCULATED?

If a policy or individual policy segments end by surrender, maturity or death any profit (the gain) may give rise to a tax liability. If a loss occurs, then no tax liability should apply.

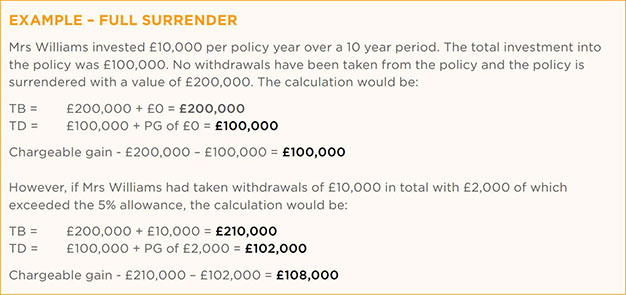

The method (as per S.491 of the Income Tax (Trading and Other Income) Act 2005) to calculate a chargeable gain is as follows:

TB – (TD + PG), which is defined as:

- TB = Total benefits - This is the surrender value of the policy, plus any previous withdrawals.

- TD = Total allowable deductions - This is the total amount invested into the policy, for the policy segments which are maturing or being surrendered.

- PG = Total amount of previous gains. This is the total amount of previous chargeable excesses created by withdrawals that exceeded the 5% cumulative allowance.

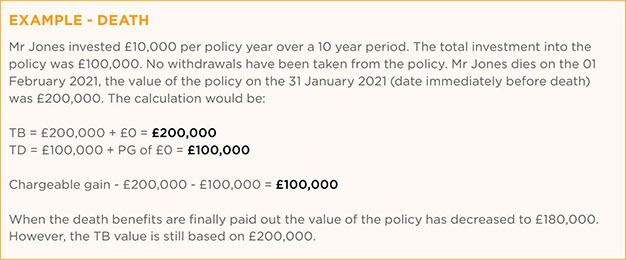

Contrary to a surrender or maturity, the chargeable gain calculation in the event of the death of any life assured that gives rise to the payment of benefits under the policy is calculated based on the value of the policy immediately prior to death and not the actual death benefit that is paid.

Therefore, if there is a gain and policy has increased in value since the date of death, then any increase is free of income tax. However, if the policy has decreases in value during this period (i.e. results in a reduction in the death benefit payable), then it is still the policy value immediately prior to death that applies for chargeable event calculation.

WHO DOES THE INCOME TAX LIABILITY FALL UPON?

- Where a policy is owned by an individual or is held in a discretionary trust created by that person (the settlor), then he/she is liable to income tax at his/her marginal rate.

- If the policy is held under a bare trust, the beneficiary is liable to the tax, as the beneficial owner of the policy, unless the donor is a parent of the beneficiary and the chargeable event occurs whilst the beneficiary is an unmarried minor. In this situation, the donor would be liable to the tax.

- If the policy is held in a discretionary trust and the settlor is non-UK resident or has died in a previous tax year, then the trustees are liable for the tax if they are UK resident.

- If the trustees are all non-UK resident, the beneficiaries of the trust resident in the UK, to the extent that they receive benefit, are liable for the tax.