What is Time Apportionment Relief and how is it calculated?

This relief applies where an offshore plan is held by a chargeable person who is UK resident for only a part of the period between the plan commencement and the chargeable event.

Time apportionment relief

Section navigation

What is Time Apportionment Relief?

TAR is a relief that can be applied to a UK chargeable gain. It allows the chargeable gain to be proportionately reduced by the amount of time the policy owner has been resident outside of the UK during the term of the policy.

Who can apply for TAR?

TAR can be claimed where the liability for tax on the chargeable event falls on an individual or the personal representatives or trustees of a deceased individual. It cannot be claimed if the policy has ever been owned by a non-UK resident trustee.

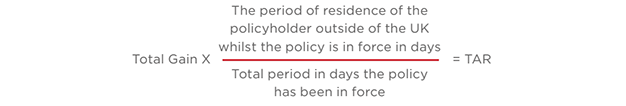

How is it calculated - Policies issued prior to 06 April 2013

TAR can be claimed for the period where the legal owner of the policy was resident outside of the UK for the period the policy has been in force. The calculation is as follows:

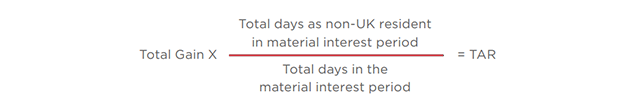

How is it calculated - Policies issued or treated as being issued post 05 April 2013

TAR can only be claimed by the individual for the period in which they beneficially own the rights under the policy or contract (material interest period). The calculation is as follows:

You can find further information on Time Apportionment Relief in our guide.